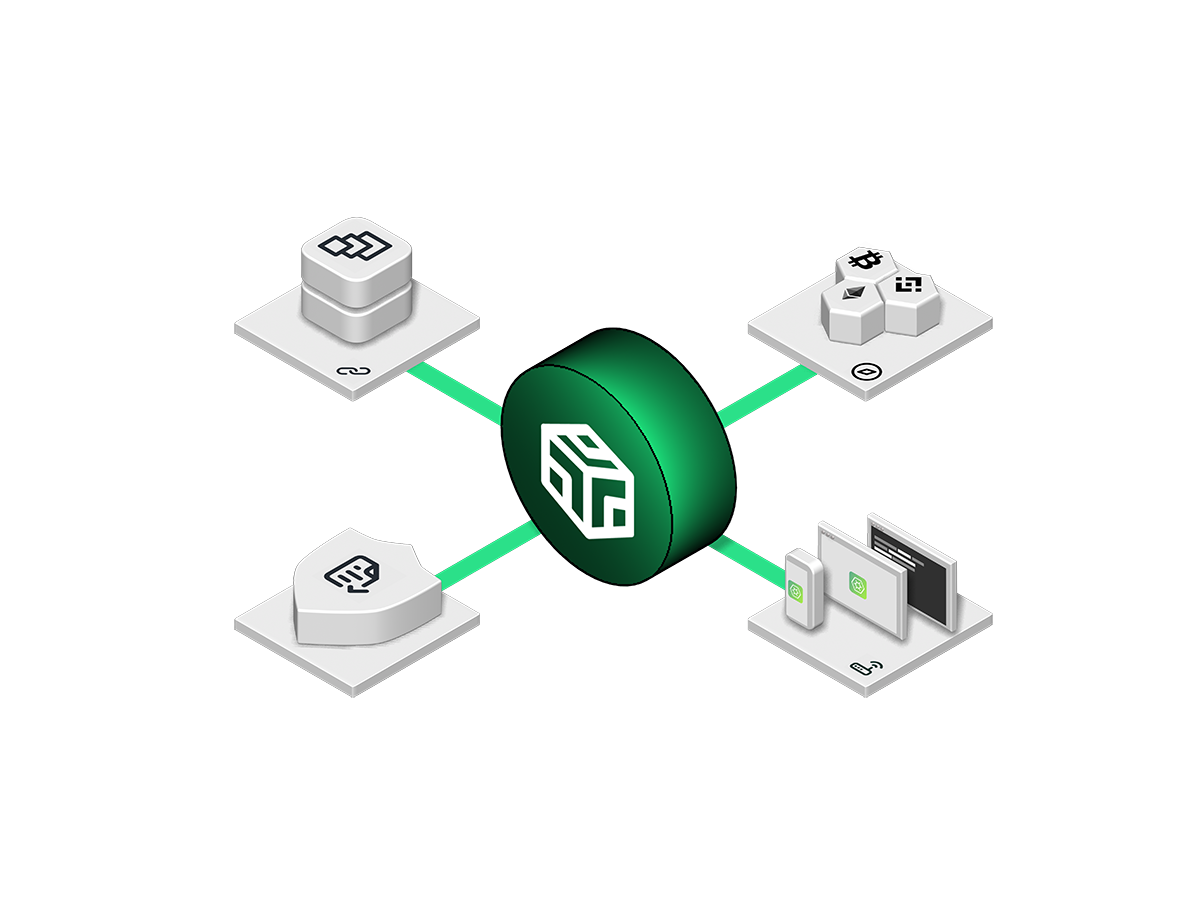

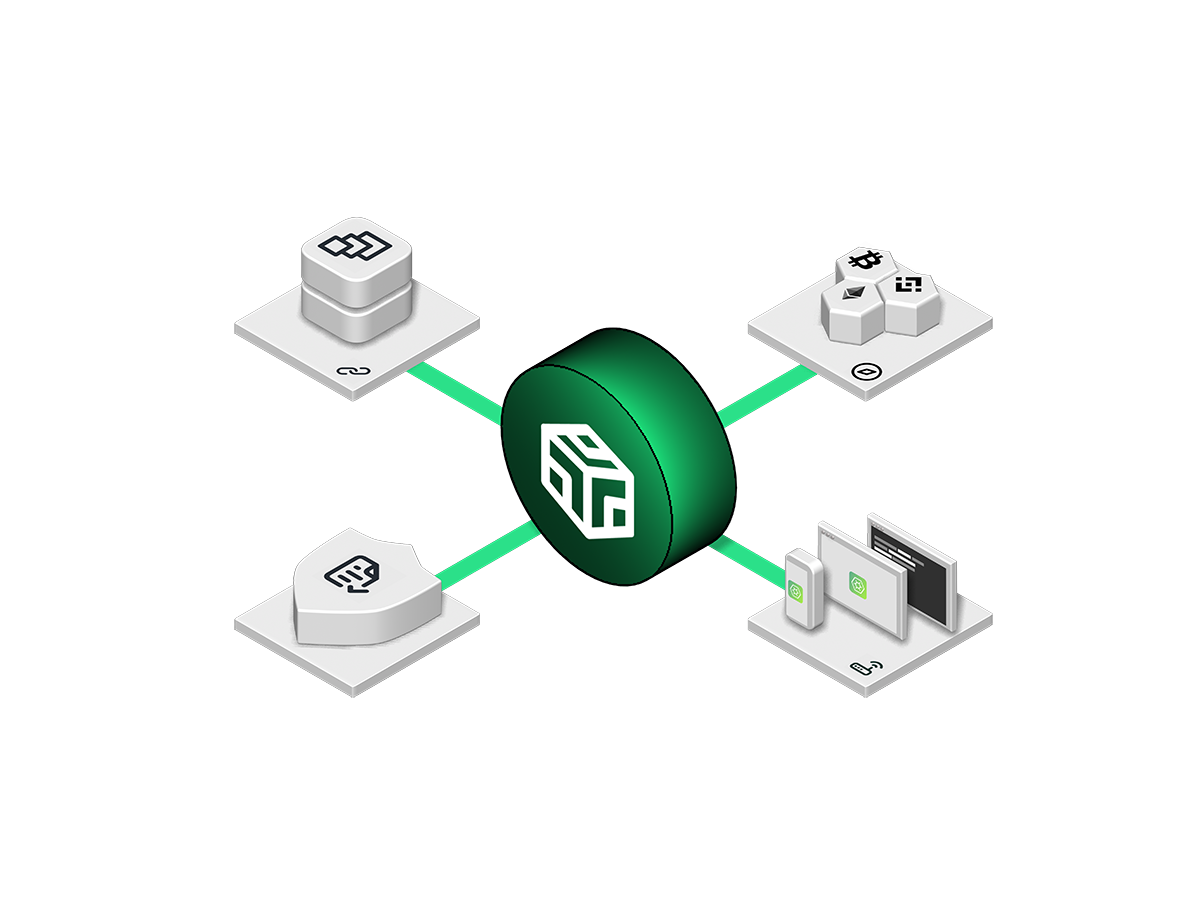

Highlighted Features

Making crypto custody safer, faster and easier

Institutional MetaMask

Get access to new protocols quickly with DeFi access to over 17000 DApps on layer 1 and 2. Generate returns with trading, staking, lending and borrowing in DeFi

FCA Registration

Bitpanda Custody is a registered cryptoassets firm with the UK Financial Conduct Authority

Cryptoasset Insurance

Crypto custody insurance provided by Marsh. Insurance information available on request.

Custom Rules

Includes DeFi Firewall, Flow processor, Threshold Signing & Multisig. Our customers can stipulate rules based on the smart contract address, methods, or parameters

DeFi Firewall

Implement DeFi Firewall rules for smart contracts - Apply manual or automated safeguard allow/deny list controls on all smart contract transactions for extra security

All Features

Compliance

Bitpanda Custody is an FCA registered custodian wallet provider, per 5th AML directive definition. Our built-in KYC and KYT controls ensure we can monitor all users and transactions for AML compliance

Compliance Webhooks

Also referred to as Webhook risk data. Inbound and outbound transaction webhook payloads include transaction risk rating and counterparty cluster information

KYC & KYT

Know Your Customer & Know Your Transaction. Our built-in KYC and KYT controls ensure we can monitor all users and transactions for AML compliance

Segregated Wallets

Easily create unlimited segregated sub-wallets, scale to accommodate more customers, and audit accounts with no commingling or rehypothecation of cryptoassets.

DeFi Reporting

Get all the details on your ethereum transactions in one view and report. Support better end-of-month reconciliation for easy compliance reporting

MultiSig

Securely share wallets with customisable Multisig. Create unique sub-wallets to segregate funds per customer, payment, etc. in real-time.

Allow Lists

Set up a "walled garden" of approved protocols, liquidity pools, trading pairs and wallet addresses to protect traders and funds from misappropriation with the DeFi Firewall.

Notifications

Receive email, mobile push and webhook notifications for crypto asset transfers, approvals, and DeFi protocol events.

Hierarchical Deterministic Wallets

Store any erc20 or EVM compatible tokens in a single sub-wallet per customer. Streamline wallet management and reduce the friction for receiving and sending transactions

API & SDK Automation

Create new addresses on demand, sign and send transactions, query balances, develop your own flows and more with our GraphQL APIs and JavaScript SDK.

Deposit Callbacks

Configure webhooks to receive HTTP callbacks whenever one of your addresses receives funds. The callback payload includes risk data and decoded transaction details

Approval Callbacks

Configure webhooks to receive sending approval HTTP callbacks, which can be processed by an automated service

Industry, Insights, News & Announcements